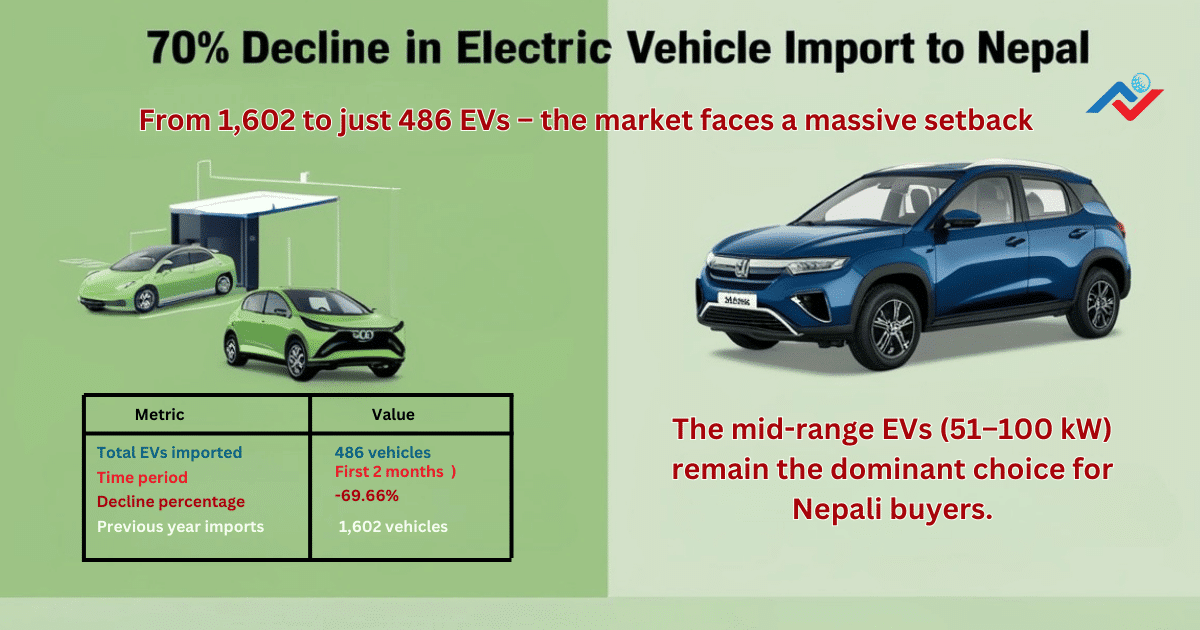

Kathmandu-Nepal’s electric vehicle market has hit a major roadblock! The latest data shows a massive 70% drop in electric vehicle import during the first two months of the current fiscal year. This dramatic decline has caught the attention of car dealers, environmentalists, and policy makers across the country.

Electric Vehicle Import Numbers

The numbers tell a concerning story for Nepal’s electric vehicle industry. In just two months (Shrawan and Bhadra), only 486 electric cars, jeeps, and vans entered Nepal – a huge drop from previous expectations.

Current Electric Vehicle Import Statistics:

- Total EVs imported: 486 vehicles

- Time period: First 2 months of fiscal year 2025/26

- Decline percentage: 69.66% compared to same period last year

- Previous year imports: 1,602 vehicles in same period

This electric vehicle import decline represents one of the steepest drops in Nepal’s automotive history, raising questions about the future of clean transportation in the country.

What These Numbers Really Mean:

The electric vehicle import figures show that Nepal imported more than 1,100 fewer EVs compared to last year’s same period. This isn’t just a small dip – it’s a major shift that could impact Nepal’s environmental goals and modern transportation plans.

For car buyers looking for electric vehicles, this means fewer options in showrooms and potentially higher prices due to limited supply.

Comparison with Last Year

The electric vehicle import comparison with last year reveals the true scale of this decline:

| Period | EVs Imported | Difference | Percentage Change |

|---|---|---|---|

| 2024/25 (Same Period) | 1,602 vehicles | – | Base year |

| 2025/26 (Current) | 486 vehicles | -1,116 vehicles | -69.66% |

Why This Electric Vehicle Import Drop Matters:

Environmental Impact: Fewer electric vehicles mean more people might buy petrol/diesel cars, increasing pollution in Nepal’s cities.

Economic Impact: Less foreign currency spent on EV imports, but also missed opportunities for clean technology adoption.

Market Confidence: Such a dramatic drop might indicate problems in Nepal’s EV market or policies.

Future Goals: This decline could delay Nepal’s plans to increase electric vehicle usage for better air quality.

The electric vehicle import statistics show that Nepal imported almost 70% fewer EVs, which is a significant concern for anyone interested in clean transportation and environmental protection.

Power Category Breakdown

The electric vehicle import data shows interesting patterns across different power categories:

Electric Vehicle Import by Power Range:

Below 50 Kilowatts:

- 73 vehicles imported

- These are typically smaller electric cars suitable for city driving

51-100 Kilowatts Range:

- 378 vehicles imported

- Most popular category, including mid-size electric cars and SUVs

- Good balance of power and efficiency

101-200 Kilowatts Range:

- 34 vehicles imported

- High-performance electric vehicles with more power

- Usually more expensive models

201-300 Kilowatts Range:

- Only 1 vehicle imported

- Ultra-high performance electric vehicles

- Very expensive and rare in Nepal market

What This Electric Vehicle Import Pattern Shows:

The majority of electric vehicle imports (378 out of 486) fall in the 51-100 kilowatt range, suggesting that Nepali buyers prefer moderately powered EVs that offer good performance without being too expensive.

The fact that only 1 ultra-high performance EV was imported shows that Nepal’s market is still focused on affordable and practical electric vehicles rather than luxury models.

Tata EV Daily Installment: Own Electric Car for Just NPR 622/Day in Nepal

Investment and Revenue Impact

The financial side of electric vehicle import tells an important story about money flow and government revenue:

Electric Vehicle Import Investment:

Total Investment by Nepali Businesses:

- Amount spent: Rs 1.27 billion (1 Arab 27 Crore 84 Lakh 29 Thousand)

- Time period: Shrawan and Bhadra months only

- Purpose: Purchasing electric vehicles from various countries

Government Revenue from Electric Vehicle Import:

Total Revenue Collected:

- Amount earned: Rs 80.67 million (80 Crore 67 Lakh 12 Thousand)

- Source: Import taxes, duties, and fees on electric vehicles

- Time period: Same 2-month period

Financial Analysis:

Revenue Percentage: The government collected about 6.3% of the total import value as revenue, which is relatively reasonable for encouraging electric vehicle adoption.

Investment Drop: With 70% fewer electric vehicle imports, total business investment in EVs has also dropped significantly, affecting the entire automotive supply chain.

Economic Impact: Less money going to foreign countries for EV purchases, but also less economic activity in Nepal’s automotive sector.

This electric vehicle import decline means both businesses and government are seeing reduced activity in the clean transportation sector.

Reasons Behind EV Import Decline

Several factors might be contributing to this dramatic electric vehicle import drop:

Possible Economic Factors:

Higher Import Costs: Rising international prices of electric vehicles might be making them too expensive for Nepali buyers.

Currency Issues: If the Nepali Rupee has weakened against major currencies, importing electric vehicles becomes more costly.

Credit Availability: Banks might be more cautious about providing loans for electric vehicle purchases.

Economic Uncertainty: General economic conditions might be making people postpone big purchases like cars.

Policy and Infrastructure Challenges:

Charging Infrastructure: Limited charging stations across Nepal might be discouraging people from buying electric vehicles.

Import Policies: Changes in government policies or procedures might be affecting electric vehicle imports.

Tax Structure: Any changes in import duties or taxes could impact EV affordability.

Documentation: More complex import procedures might be slowing down the process.

Market-Specific Issues:

Seasonal Factors: The first two months might traditionally be slower for car sales in Nepal.

Model Availability: Fewer attractive electric vehicle models might be available in the price range Nepali buyers prefer.

Competition: Improved fuel-efficient petrol cars might be competing better with electric vehicles.

Consumer Awareness: People might still have concerns about electric vehicle performance, maintenance, or resale value.

Market Analysis

Toyota bZ3X electric SUV launched in China, developed with GAC Group.

The electric vehicle import decline raises important questions about Nepal’s automotive market:

Current Market Conditions:

Buyer Behavior: Nepali car buyers might be waiting for better electric vehicle options or lower prices before making purchases.

Dealer Impact: Car dealers specializing in electric vehicles are likely facing inventory shortages and reduced sales.

Competition: Traditional petrol and diesel vehicles might be gaining market share due to this EV supply shortage.

Price Trends: With fewer electric vehicles available, prices in the local market might be increasing.

Comparison with Global Trends:

While many countries are seeing increased electric vehicle adoption, Nepal’s 70% decline goes against the global trend. This suggests Nepal-specific challenges rather than worldwide issues affecting electric vehicle demand.

Impact on Different Stakeholders:

Car Buyers: Fewer choices, potentially higher prices, longer waiting periods for electric vehicles.

Dealers: Reduced inventory, lower sales volumes, uncertain business prospects.

Government: Lower revenue from import duties, potential delay in environmental goals.

Environment: More traditional vehicles on roads could increase pollution levels in Nepal’s cities.

Future of Electric Vehicles in Nepal

Despite the current electric vehicle import decline, the long-term outlook for EVs in Nepal depends on several factors:

Positive Factors for Recovery:

Environmental Awareness: Growing concern about air pollution in Nepal’s cities could drive demand for electric vehicles.

Fuel Prices: Rising petrol and diesel prices make electric vehicles more attractive economically.

Technology Improvement: Better batteries and longer range could address consumer concerns about electric vehicles.

Infrastructure Development: More charging stations would encourage EV adoption.

Challenges to Address:

Affordability: Making electric vehicles more accessible to middle-class Nepali buyers.

Infrastructure: Building a reliable network of charging stations across the country.

Policy Support: Clear government policies supporting electric vehicle adoption.

Awareness: Educating consumers about electric vehicle benefits and addressing misconceptions.

Market Predictions:

Short-term (6-12 months): Electric vehicle imports might remain low unless specific issues are addressed.

Medium-term (1-3 years): Recovery possible if infrastructure improves and prices become more competitive.

Long-term (3+ years): Strong potential for growth as global EV technology advances and becomes more affordable.

Government Response and Policy Implications

This electric vehicle import decline might prompt government action:

Possible Policy Responses:

Tax Incentives: Reducing import duties or providing tax breaks for electric vehicle buyers.

Infrastructure Investment: Accelerating charging station installation across Nepal.

Awareness Campaigns: Educating public about electric vehicle benefits.

Import Facilitation: Simplifying procedures for electric vehicle imports.

Strategic Considerations:

Environmental Goals: Nepal’s commitment to reducing carbon emissions might require stronger EV promotion policies.

Economic Balance: Balancing support for electric vehicles with revenue needs from import duties.

Market Development: Creating conditions for sustainable electric vehicle market growth.

International Cooperation: Working with other countries and organizations to support EV adoption.

Consumer Perspective on Electric Vehicle Import Decline

From the buyer’s point of view, this electric vehicle import situation creates both challenges and opportunities:

Current Challenges for Buyers:

Limited Options: Fewer electric vehicle models available in Nepal showrooms.

Higher Prices: Reduced supply might lead to increased prices for available EVs.

Longer Wait Times: Customers might need to wait longer for their preferred electric vehicle models.

Uncertainty: Unclear market conditions make purchase decisions more difficult.

Potential Opportunities:

Better Deals: Dealers might offer attractive packages to clear existing inventory.

Improved Models: When imports recover, newer and better electric vehicle models might be available.

Policy Support: Government might introduce buyer-friendly policies to boost the market.

Infrastructure Growth: Time for charging network to expand before next wave of EV purchases.

Impact on Nepal’s Transportation Sector

The electric vehicle import decline affects broader transportation planning in Nepal:

Immediate Effects:

Public Transport: Slower adoption of electric buses and taxis.

Private Transport: More people likely to choose traditional vehicles.

Commercial Transport: Delivery and logistics companies might delay EV adoption plans.

Tourism Industry: Fewer electric vehicles available for environmentally conscious tourists.

Long-term Transportation Planning:

Urban Planning: Cities might need to adjust pollution control strategies.

Infrastructure Investment: Questions about pace of charging station development.

International Image: Impact on Nepal’s environmental commitments and green image.

Economic Development: Potential delay in developing clean transportation sector.

Conclusion

The 70% decline in electric vehicle import to Nepal represents a significant setback for the country’s clean transportation goals. With only 486 EVs imported in the first two months compared to 1,602 in the same period last year, this dramatic drop raises important questions about market conditions, policies, and future strategies.

While Nepali businesses invested Rs 1.27 billion in electric vehicle purchases and the government collected Rs 80.67 million in revenue, these figures represent substantial decreases from previous trends. The dominance of mid-range electric vehicles (51-100 kilowatts) in the import mix shows that affordability remains a key concern for Nepali buyers.

This electric vehicle import decline doesn’t necessarily mean the end of Nepal’s EV dreams, but it does highlight the need for coordinated action from government, businesses, and consumers. Issues like charging infrastructure, affordability, awareness, and policy support need urgent attention to revive the market.

For Nepal to achieve its environmental goals and provide citizens with clean transportation options, addressing the factors behind this electric vehicle import decline should be a priority. The current situation presents both challenges and opportunities – the key is learning from this setback to build a stronger, more sustainable electric vehicle market in the future.

The next few months will be crucial in determining whether this is a temporary dip or a longer-term trend that requires significant intervention to reverse.

External Resources:

![Nepal Voter Registration Now Possible at Any Election Office – Complete Guide [2025 updated]](https://nepaliict.com/wp-content/uploads/2025/10/Nepal-voter-registration.jpg)

Comments