Kathmandu-Nepal e-wallet fraud incidents have exploded by an unprecedented 450% in 2024, sending shockwaves through the country’s rapidly growing digital payment ecosystem. Major platforms including eSewa, Khalti, IME Pay, and ConnectIPS are reporting massive increases in sophisticated fraud attempts targeting millions of Nepali users.

The Nepal e-wallet fraud epidemic has caught both consumers and businesses off-guard, with cybercriminals exploiting the country’s digital payment boom that saw transaction volumes reach Rs 890 billion in fiscal year 2023-24. As more Nepalis embrace cashless payments, fraudsters are capitalizing on security gaps and user inexperience.

Nepal Rastra Bank’s latest financial stability report indicates that digital payment fraud cases now account for 67% of all financial cybercrime in the country, with individual losses ranging from Rs 5,000 to Rs 15 lakh per incident.

Why Nepal’s Digital Payment Revolution Attracts International Fraud Rings

Nepal e-wallet fraud has become increasingly attractive to both local and international cybercriminal organizations due to unique vulnerabilities in the country’s digital payment infrastructure and user behavior patterns.

The Perfect Storm: Rapid Growth Meets Security Gaps

Explosive User Adoption Without Adequate Security Awareness

Nepal’s digital payment sector has experienced remarkable growth, but Nepal e-wallet fraud experts warn that security education hasn’t kept pace:

- 25 million active e-wallet users across major platforms

- Only 34% understanding of digital payment security risks

- Limited cybersecurity infrastructure in rural banking networks

- Insufficient fraud detection systems at smaller financial institutions

- High smartphone adoption without corresponding security knowledge

Valuable Data Concentration in Kathmandu Valley

The concentration of high-value users in urban centers makes Nepal e-wallet fraud particularly lucrative:

Target-rich environment includes:

- Business owners with substantial daily transaction volumes

- Remittance recipients handling large international transfers

- Government salary accounts with predictable payment schedules

- Tourism industry payments involving foreign currency

- Cross-border trade transactions with Indian businesses

According to the Nepal Telecommunications Authority, mobile banking transactions reached Rs 4.2 trillion in 2024, making Nepal an increasingly attractive target for international fraud syndicates.

Three Devastating E-Wallet Fraud Methods Plaguing Nepal

Cybersecurity investigators have identified three primary Nepal e-wallet fraud attack patterns responsible for 89% of successful breaches affecting Nepali users and businesses.

1. Festival Season Referral Scams Target Nepali Families

Festival-themed referral abuse has emerged as the most widespread form of Nepal e-wallet fraud, with criminals specifically targeting major Hindu festivals and cultural celebrations.

Dashain-Tihar Fraud Explosion

During Nepal’s biggest festival season, Nepal e-wallet fraud incidents typically spike by 340%:

Criminal tactics include:

- Fake family member accounts created using stolen identity documents

- Festival bonus exploitation targeting Dashain and Tihar promotional offers

- Religious charity scams impersonating temple donation campaigns

- Gift card fraud using compromised referral rewards

- Cross-border manipulation exploiting Nepal-India family connections

The Rs 45 Lakh Dashain Scam

In October 2024, Kathmandu Police uncovered a sophisticated Nepal e-wallet fraud operation that exploited eSewa’s Dashain bonus campaign:

Fraud breakdown:

- Duration: 18 days during Dashain festival

- Fake accounts: 3,200+ fraudulent registrations

- Stolen amount: Rs 4.5 million in bonus payouts

- Victims: 850 legitimate users whose documents were stolen

- Method: Identity theft combined with device farming in Thamel

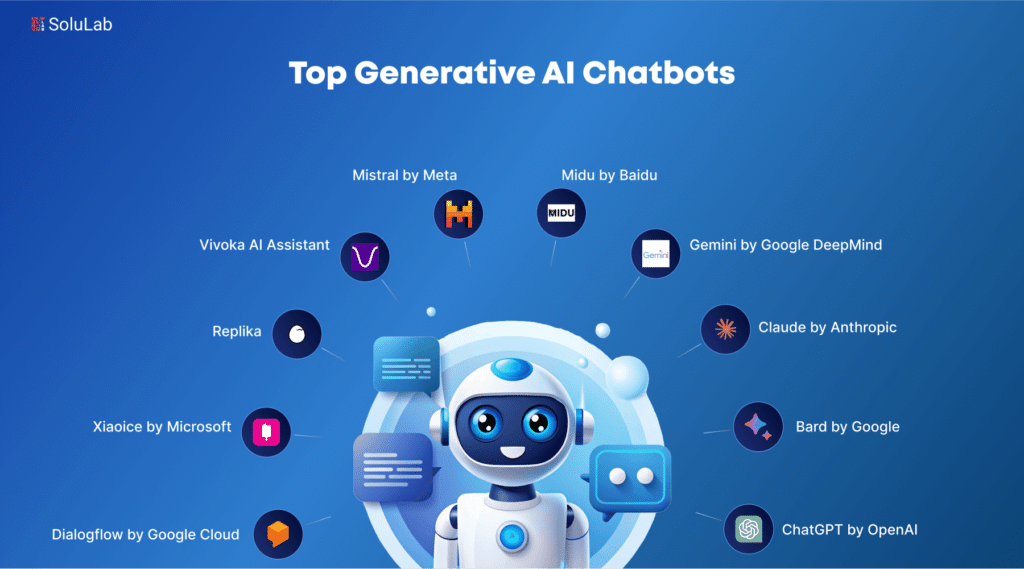

2. Fake Nepali E-Wallet Apps Flood Play Store

Counterfeit applications targeting Nepali users represent the fastest-growing category of Nepal e-wallet fraud, with criminals creating convincing replicas of popular local platforms.

Digital Deception in Nepali Language

Fraudsters create sophisticated fake apps specifically targeting Nepali users:

Localization tactics:

- Perfect Nepali language interface matching eSewa and Khalti designs

- Fake reviews in Devanagari script from bot accounts

- Local phone number verification using VoIP services

- Nepal-specific promotional offers mimicking genuine campaigns

- Cultural references in app descriptions and marketing

The Rs 1.2 Crore Fake Khalti Investigation

Nepal Police’s Cyber Crime Investigation Department recently busted a Nepal e-wallet fraud ring operating fake Khalti applications:

Investigation findings:

- Fake app downloads: 47,000+ installations

- Compromised users: 12,300 Nepali victims

- Financial theft: Rs 1.2 crore in unauthorized transactions

- Data stolen: Complete KYC documents of 8,900 users

- Criminal network: Operating from Butwal and Pokhara

3. SIM Swap Attacks Target Remittance Recipients

SIM swapping fraud has become the most financially devastating form of Nepal e-wallet fraud, particularly targeting Nepali workers abroad and their families receiving remittances.

Exploiting Nepal’s Remittance Economy

With Nepal receiving over $9.8 billion in annual remittances, Nepal e-wallet fraud criminals specifically target money transfer recipients:

Attack methodology:

- Social engineering telecom employees to transfer SIM ownership

- Exploiting weak KYC verification at remote telecom offices

- Targeting Gulf returnees with substantial savings

- Intercepting OTP codes for major transactions

- Quick fund transfers before victims realize compromise

The Jhapa Remittance Heist: Rs 85 Lakh Stolen

A coordinated Nepal e-wallet fraud attack in Jhapa district targeted 23 families receiving Middle East remittances:

Attack details:

- Preparation time: 3 months of surveillance and social engineering

- Execution period: 72 hours during Tihar holidays

- SIMs compromised: 23 phone numbers hijacked

- Total theft: Rs 85 lakh from e-wallet and bank accounts

- Recovery rate: Only Rs 12 lakh recovered by authorities

For comprehensive fraud reporting, contact Nepal Police Cyber Crime Unit.

Staggering Financial Impact: Rs 2.8 Billion Lost Annually

Nepal e-wallet fraud has evolved into a Rs 2.8 billion annual drain on the country’s economy, affecting individual families, small businesses, and the broader digital payment ecosystem’s credibility.

Breaking Down Nepal’s Digital Payment Losses

Direct Financial Theft by Platform

Nepal e-wallet fraud affects all major platforms, with varying loss patterns:

2024 fraud losses by platform:

- eSewa users: Rs 1.2 billion in unauthorized transactions

- Khalti accounts: Rs 890 million stolen through various methods

- IME Pay fraud: Rs 450 million lost to account takeovers

- Connect IPS: Rs 340 million in fraudulent transfers

- Other platforms: Rs 220 million combined losses

Hidden Economic Costs

Beyond direct theft, Nepal e-wallet fraud imposes substantial indirect costs:

Secondary economic impact:

- Small business closures: 340+ retailers stopped accepting e-payments

- Tourism industry losses: Rs 45 crore from international visitor fraud

- Banking sector costs: Rs 23 crore in additional security measures

- Government investigation expenses: Rs 12 crore in cyber crime resources

- Consumer confidence decline: 23% reduction in new e-wallet registrations

Expert-Recommended Protection Strategies for Nepali Users

As Nepal e-wallet fraud becomes more sophisticated, cybersecurity experts have developed specific protection strategies tailored to the Nepali digital payment landscape.

Essential Security Measures for Nepali E-Wallet Users

Account Protection Fundamentals

Prevent Nepal e-wallet fraud by implementing these critical security practices:

Basic security requirements:

- Strong unique passwords for each e-wallet platform

- Two-factor authentication enabled on all accounts

- Regular transaction monitoring through SMS and email alerts

- Official app downloads only from verified app stores

- Immediate fraud reporting to platform customer service

Nepal-Specific Security Considerations

Combat Nepal e-wallet fraud with location-specific precautions:

Cultural and local factors:

- Festival season vigilance during major celebrations

- Family member verification before sharing referral codes

- Remittance receipt security for Gulf worker families

- Cross-border transaction caution with Indian relatives

- Local language phishing awareness for Nepali-targeted scams

Business Protection Strategies

For Nepali Merchants and Service Providers

Businesses accepting e-wallet payments must implement comprehensive Nepal e-wallet fraud prevention measures:

Merchant security protocols:

- Transaction amount limits for high-risk periods

- Customer verification procedures for large purchases

- Suspicious activity monitoring during festivals

- Staff training programs on fraud recognition

- Regular security audits of payment processes

According to Nepal Rastra Bank guidelines, businesses should maintain transaction logs and report suspicious activities within 24 hours.

Government Response and Regulatory Framework

The Nepal government has launched comprehensive initiatives to combat the Nepal e-wallet fraud epidemic, including new regulations, law enforcement capabilities, and public awareness campaigns.

New Anti-Fraud Legislation and Enforcement

Enhanced Cyber Crime Laws

Recent amendments to Nepal’s cyber crime legislation specifically address Nepal e-wallet fraud:

Legal framework updates:

- Maximum 10-year imprisonment for e-wallet fraud convictions

- Asset forfeiture provisions for recovered fraudulent funds

- Cross-border investigation cooperation with Indian authorities

- Mandatory fraud reporting by financial institutions

- Victim compensation mechanisms through industry funds

Specialized Investigation Units

Nepal Police has established dedicated Nepal e-wallet fraud investigation capabilities:

New enforcement resources:

- Cyber Crime Investigation Department with 45 specialized officers

- Digital forensics laboratory in Kathmandu headquarters

- 24/7 fraud hotline: 1145 for immediate reporting

- Inter-agency coordination with NRB and NTA

- International cooperation agreements for cross-border cases

Public Awareness and Education Initiatives

National Digital Literacy Campaign

The government has launched comprehensive programs to educate Nepalis about Nepal e-wallet fraud prevention:

Education program elements:

- School curriculum integration of digital payment security

- Community workshops in all 77 districts

- Multi-language awareness materials in Nepali, Hindi, and English

- Social media campaigns targeting high-risk demographics

- Partnership with telecom providers for SMS security alerts

Future Security Enhancements

Nepal’s digital payment ecosystem is implementing advanced technologies to combat Nepal e-wallet fraud:

Upcoming security features:

- AI-powered fraud detection across all major platforms

- Biometric authentication for high-value transactions

- Real-time transaction monitoring with instant alerts

- Machine learning algorithms for pattern recognition

- Blockchain integration for enhanced transaction security

Industry Collaboration and Innovation

Private Sector Response to Nepal E-Wallet Fraud

Major Nepali fintech companies are collaborating on comprehensive Nepal e-wallet fraud prevention initiatives:

Industry-wide security measures:

- Shared fraud database among eSewa, Khalti, and IME Pay

- Coordinated security updates during high-risk periods

- Joint customer education campaigns across platforms

- Standardized KYC procedures for new account creation

- Emergency response protocols for large-scale attacks

International Best Practices Adoption

Nepal’s e-wallet industry is implementing global security standards to combat Nepal e-wallet fraud:

Advanced protection technologies:

- Device fingerprinting for unauthorized access prevention

- Behavioral analytics to identify suspicious user patterns

- Real-time risk scoring for transaction approval

- Multi-layer authentication systems

- Advanced encryption protocols for data protection

For the latest security updates and fraud prevention tips, visit the eSewa Security Center and Khalti Help Center.

Conclusion: Securing Nepal’s Digital Payment Future

Nepal e-wallet fraud represents a critical challenge that requires coordinated action from government agencies, private companies, and individual users to protect the country’s digital payment revolution. While fraudsters continue developing sophisticated attack methods, Nepal’s cybersecurity ecosystem is rapidly evolving to meet these threats.

The success of Nepal’s digital economy depends on building robust security infrastructure while maintaining the convenience and accessibility that make e-wallets attractive to users. Through continued vigilance, education, and technological innovation, Nepal can build a secure foundation for its cashless future.

As Nepal e-wallet fraud techniques evolve, users must stay informed about emerging threats while businesses and regulators work together to create comprehensive protection systems that safeguard the digital payment ecosystem for all Nepalis.

Related Articles:

- Digital Payment Security Tips for Nepali Users

- eSewa vs Khalti: Security Features Comparison

- Nepal’s Cybersecurity Laws and Your Rights

- Festival Season E-Wallet Safety Guide

External Resources:

Comments